By Dave Kelly, Minnesota Bankruptcy Attorney

Introduction

This is the second post in my series about what I consider to be the top seven bankruptcy myths. When a potential client calls me for the first time one of the most common questions I hear is “I’ll lose my house if I file bankruptcy won’t I?” OR “I’ll have to give up my car if I file bankruptcy, right?” The answer to both of these questions is almost always NO, but sometimes I have a hard time convincing the caller. This myth seems to be a very powerful one that many people have been hearing all their lives.

The Debt is Discharged but Not the Lien

In the vast majority of cases my clients get to keep their house, if they have one, and keep their car – unless for some reason they don’t want to keep these things. Please understand that bankruptcy makes the debt go away but in general it does not release the lien of a mortgage or car loan. If there is a mortgage on your house, the house will still have the mortgage when you are done with the bankruptcy. And if there is a loan against your car, properly filed with the state so that is is listed on the car title, the lien from that loan will also still be there after the bankruptcy. Unless the debt is reaffirmed, you will no longer owe personally on the car loan and mortgage. But it is very much like the car still owes the car loan and the house still owes the mortgage.

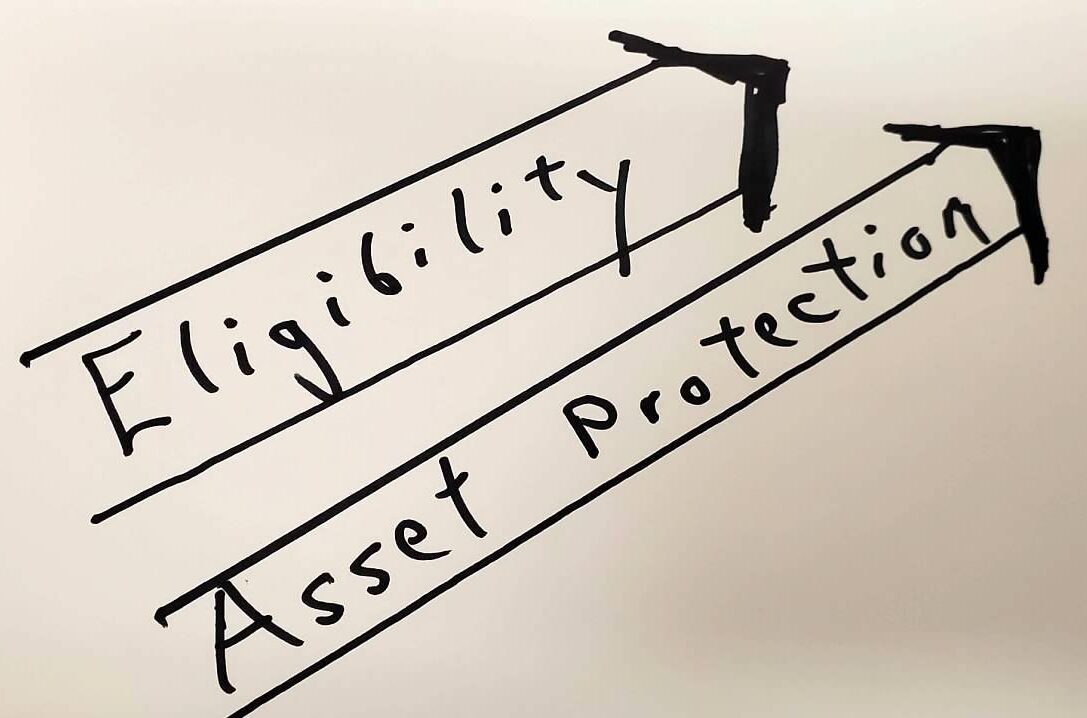

Protect Your Equity by Claiming it as Exempt

Now if there is equity in the car or house, and there usually is, that equity is an asset in the bankruptcy case. By equity I mean the difference between what is owed and what the asset is worth, assuming it is a positive number. When a straight Chapter 7 bankruptcy is filed, a trustee is appointed by the court. The trustee’s job is to find assets that can be seized and divided among the creditors. My job, however, is to prevent that from happening. With houses and cars it is usually fairly easy. The way to keep the trustee from taking an asset is to claim it as exempt. There is usually enough exemption to cover the equity in a car; and there is almost always enough Minnesota exemption to cover the equity in a house.

In Minnesota we get to choose between two exemption lists – either the state exemptions or the federal exemptions. Under the state exemptions a debtor is allowed an exemption of up to $480,000 of equity in a homestead and up to $5,200 or equity in a motor vehicle. The federal exemptions are not so good for protecting a homestead, but for a car they protect up to $4,450 of equity in a motor vehicle. The federal exemptions also contain a wile card of more than $15,000, under which anything not otherwise exempt can still be claimed as exempt. If there’s a lot of equity in a car, the wild card can be very handy to protect whatever is not covered by the automobile exemption.

Bottom Line

In the vast majority of cases, Minnesota residents who file bankruptcy are able to keep their vehicles and keep their homes. Those who tell you otherwise are perpetuating a common myth.