By David J. Kelly, Minnesota Bankruptcy Attorney

This is the final post in my series on the top seven things you should probably be doing if you are considering a Chapter 7 or a Chapter 13 bankruptcy. I don’t intend to help you with a do it yourself bankruptcy. My purpose is to introduce topics for you to discuss with your lawyer. Don’t try this by yourself.

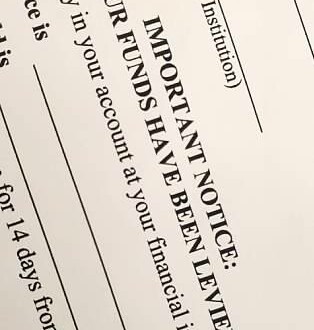

Bank Accounts Can be Frozen Without Advance Notice

Let’s say you have been sued by a creditor. The judgment has been entered and now the creditor is looking for assets to seize. To garnish your wages the creditor has to give you a ten day notice – or at least is supposed to. But in Minnesota no advance notice is required before a garnishment of a checking or savings account. If the creditor garnishes your bank account, the first you may hear about it is when your bank or credit union notifies you that the account is frozen. Before you even get notified by your bank or credit union, you may notice that your checks are bouncing, your payments are not going through, and the pay check that was recently deposited is now beyond your reach.

You Must Claim All or Part of the Account as Exempt to Get Access to Your Account Again

More than likely all or a good part of the money in your account is exempt and cannot be taken by the creditor. After the account is frozen, you will be (or are supposed to be) given an Exemption Form that you can use to claim your exemptions. You might not receive this for a few days after the account is frozen. Then you have to fill it out and send it back to the creditor’s lawyer. Once the lawyer receives it, he or she is supposed to release to you that part of the money in the account which is exempt. Days can pass, even a couple of weeks, before this process is completed. Then you can use your account again, minus whatever amount the creditor took out of it. More accurately stated, you can use your account again until the next time the creditor garnishes it.

Avoiding or Minimizing the Freezing of Your Bank Account

Maybe this can’t be avoided, but the problem can be minimized. One thing you can do is what I suggested in Item 3 of this series: Move your money to a bank that will be harder to find. Creditor’s attorneys often send out a shotgun blast of garnishment notices to all the major banks. They don’t know where you bank, but chances are that if you are using one of the larger banks your account will get caught in the net. People have been surprised and asked me how the creditor knew where they banked. The answer is that the creditor didn’t know, they just got lucky. I love the little banks that nobody has heard of. Any bank whose name starts with “State Bank of ….” is probably a good bet.

Another thing you can do is just keep the bank balance as low as possible. The creditor can only freeze what is in the account. This might involve making cash withdrawals and cash deposits as needed to cover the things that must be paid out of the checking account. The back and forth movement of cash may look suspicious to a bankruptcy trustee. The trustees are always looking for evidence that money is being hidden. You and your lawyer might have to explain why this is being done. But once the trustee understands that this is merely an effort to avoid or minimize garnishment, it should be OK. We will have to be careful to accurately disclose the cash on hand in your bankruptcy forms. All assets have to be disclosed.

No One Size Fits All Solutions

This topic is something you are going to have to discuss with your lawyer. Cash can be harder to claim as exempt than money in the bank, at least in a state exemption case. If you are using the state exemptions and not the federal exemptions, having large amounts of cash might be a really bad idea. You might be setting yourself up to have the bankruptcy trustee take your money, which is just as bad as having it garnished. There are no one size fits all solutions. Don’t do any of what I discuss here without being advised by your attorney.

Call Dave at 952-544-6356.