By Dave Kelly, Minnesota Bankruptcy Lawyer

I don’t claim to be a credit expert. What I know about credit and the effect of bankruptcy filing on it is what I hear from my clients. Almost everything I know is hearsay. It would not be admissible as evidence in court. But I’ve heard the same thing many times and from many different people. I may have some wisdom on the subject that I can pass along.

Won’t Bankruptcy Wreck My Credit?

One of the most common questions I hear is on the phone is “won’t filing bankruptcy wreck my credit forever?” Typically these callers are deep in debt. They are spending all their energy trying to juggle various credit accounts – accounts that they will never be able to pay. They may be using credit to pay credit, taking cash advances on one to make payments on another. The juggling act gets to the point that it is hard to think about or imagine anything else.

The answer to the question is NO. It is true that the bankruptcy filing will show on your credit report for ten years. But it is not true that your credit will be harmed for that whole time.

You’ll Get Credit Offers Right After Your Bankruptcy is Filed

Almost as soon as the case is filed, there are predatory lenders who will offer you credit cards and car loans. The terms for these will be terrible. Interest rates will be high, late fees will be high, and credit limits will be low. It is best to avoid these credit offers if you can. My advice as a general rule usually is stay away from these offers and live without credit for a while. One exception might be when you need a credit card for work or for essential travel. If you do get such a card, it’s important to pay it off every month. Don’t let them get their hooks into you again.

Another exception would be when you just have to get another car. Surrendering your previous car might have been necessary. You may have been really up-side-down on the loan, or you may have had a catastrophic mechanical issue. But now the only way to get another vehicle might be to get one of the loans you are being offered.

Three Years After Bankruptcy

Your credit prospects will improve with time. Within one year after your bankruptcy, you may be surprised to see your credit score going up. At first that doesn’t necessarily mean that you will be eligible for much. But after a couple more years of clean living, you will start noticing that your credit has bounced back. At about the three year mark after the case is completed, I will typically get a phone call from my former clients. My clients tell me that they are about to refinance a mortgage, buy a house or buy a car. There is a loan officer who says the loan will be approved, but first some details about the bankruptcy are needed. This is info that I can email. They thank me for my help in getting the loan. Also they usually tell me that things are really going well and they are glad they did the bankruptcy.

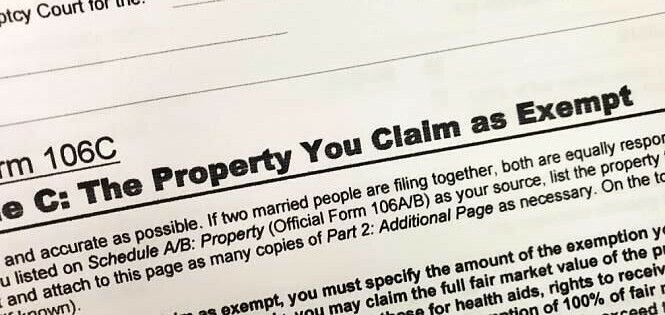

There is a point somewhere between three and five years after the case is done where the bankruptcy just doesn’t affect credit any more. The greatly improved debt to income ratio may even result in much better credit than before.

Credit Might Not Be Helping You

Maybe your credit looks pretty good right now. But if you are doing a juggling act to keep it up, it might be hurting you more than helping. Imagine what it would be like to get off the treadmill and be free of all that debt. If you could just get rid of all that debt, there wouldn’t be such a great need for more and more credit. Perhaps it’s time to call someone to explore the fresh start that bankruptcy offers.