By Dave Kelly, Minnesota Bankruptcy Lawyer

What Happens at the Meeting of Creditor Hearing

About a month after a personal bankruptcy is filed, whether it’s a Chapter 7 or a Chapter 13, there is a hearing they call the “First Meeting of Creditors.” Most of the time I just call it the “hearing”, although the official name is “First Meeting of Creditors.” I think “hearing” is a more accurate term because for one thing, in the vast majority of cases, the last thing you will ever see at one of these events is a creditor. The creditors are invited to appear, but they know it’s a waste of their time and almost never show up.

“Hearing” is also a good way to describe what happens. The process is presided over by either the bankruptcy Trustee or a lawyer on the staff of the bankruptcy Trustee. This Trustee is not a judge, but from my perspective he or she might was well be. Nobody has more power or influence over how the case goes than the Trustee. The person who filed the bankruptcy is put under oath and asked a series of questions. Depending on the answers, things can expand into even more questions. In a simple case it might only take ten minutes. But I have seen complicated cases where it has taken over an hour; and in those more complicated cases it can easily take more than one sitting.

Traditionally these hearings/Meetings of Creditors always took place at a federal courthouse or some other location like a federal courthouse, depending on the county in which the Debtor lived. I would put on my traditional lawyer outfit, including my lawyer shoes, and head for the designated location. I had it down to a science. I knew where I wanted to park and where I wanted to meet my clients before the hearing. It was usually kind of fun, because I would see my lawyer friends there. This was the norm. It was how things were done.

Covid Hit and Everything Changed

In early 2020 when Covid hit the whole process changed dramatically. The Trustees started conducting these hearings remotely by Zoom or some similar method. Everyone assumed this change was temporary and we’d be back to the courthouses when the virus passed. It never occurred to any of us that the change might become permanent. There may have been jokes about it becoming permanent, but nobody considered it a serious possibility – at first.

But I did start noticing that not going downtown saved time, and grief and parking money. People including the Trustees started to like doing it remotely, so did I. Many of my clients said they didn’t want to go downtown and expressed relief that we were not going to have to. My clients could stay home if they wanted to and do the hearing from there; but it has always been my preference to have them come to my office for the hearing. Even if we are not going down to a courthouse, I still think there is a tremendous benefit to being physically present in the same room with my clients when this hearing takes place. As I have always done, I like to meet early before the hearing with my clients and do preparation. I almost always know approximately what the Trustee will be asking. I want to go over the expected questions with my client and have my client as ready as possible.

When Are We Going Back to In-Person? Never!

Late last year as I usually do I attended the Bankruptcy Institute, a big series of classes and talks put on by Minnesota Continuing Legal Education. I was assuming that one of the things I would learn would be what the plans were for returning to in-person hearings for the Meetings of Creditors. In-person hearings were already taking place before the judges for the more complicated matters such as motions, adversary proceedings and reaffirmation agreements. Instead what I heard was that the switch to remote for the Meetings of Creditors was going to be made permanent. A nationwide protocol for doing it by Zoom on a permanent basis was going to be promulgated some time in 2023.

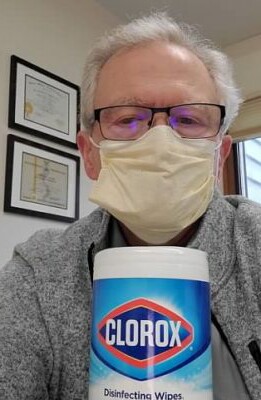

My Lawyer Shoes Continue to Gather Dust

Usually I manage to avoid those in-person hearings in front of the judges. Those tend to only be required if something has gone wrong with the case. If the case is put together well, we should be able to stay away from the judges. So these days I am only dressing like a lawyer from the waist up. It may be a long time if ever that I again have to wear the pants that come with my suit. The same goes for my lawyer wingtip shoes, which have been gathering dust in the corner of my bedroom. Maybe I’ll just have to wear the pants and the shoes some time for the heck of it.

Call Dave at 952-544-6356