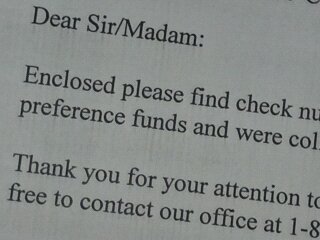

I just love when this happens. I came in to the office this morning, checked the mail box, and here’s letter from one of the big bill collecting law firms. Often those  letters can be some kind of bad news, but today the letter contained a check for over $1000 for one of my clients. This was a refund of the money that they garnished from my client’s pay check in the 90 days before we filed the bankruptcy.

letters can be some kind of bad news, but today the letter contained a check for over $1000 for one of my clients. This was a refund of the money that they garnished from my client’s pay check in the 90 days before we filed the bankruptcy.

So you might wonder how this can be. After all, once a bill collector takes your money isn’t is just gone? Most of the time it really is just gone, forever. An exception to the rule, however, can be money that was garnished or seized within 90 days before the filing either of a Chapter 7 or a Chapter 13 bankruptcy. The window for getting the money back is a pretty small one. It’s necessary to have all the following before any of the money can come back:

- It must be a case where the amount seized in the 90 days is over $600. If it’s over that amount, it counts as what is called a “preference.” If it’s less than that, it doesn’t count at all.

- It has to be a bankruptcy case where the debtor is using the federal exemptions.

- The debtor has to have claimed the preference amount as exempt using the wild card exemption under the federal exemptions.

- The bankruptcy trustee has to have not objected to the claim of exemption for the preference. The trustee has 30 days from the date of the meeting of creditors – what I call the hearing – to object to exemptions. So this means that the 30 day time period has to have expired.

- You have to actually contact the creditor or the creditor’s lawyer and ask for the money back. If they won’t give it back, which is often the case, legal action can be taken to get it back. I tell my clients to not bother with the legal action, however, because the attorney fees would probably cost more than you would ever get back.

So what I tell my clients when we have this situation is that I will set up the bankruptcy petition so that the money is listed as a preference under assets and them claimed as exempt. When the 30 day exemption period expires, I will write a letter and demand the money. Then we wait and see if the money turns up. It only does in about half or less of the cases.

Many of the creditors are so nasty that they don’t care if the law requires them to give the money back. They know that nobody can afford to pursue them if they don’t. But I am always joyful to see that check come in the cases where they do.

This post is for general information purposes only and does not create an attorney-client relationship. It is not legal advice. Please consult the attorney of your choice concerning the details of your case. I am a debt relief agency helping people to file for relief under the federal bankruptcy code.