In bankruptcy, either Chapter 7 or 13, there is a counseling requirement – one course that must be taken before the case is filed and another that must be taken before the case can be discharged.

One of the things that keeps me awake at night is the possibility that one of my clients might miss the deadline for the second course and have their discharge refused as a result. I ask my clients to please have the second course done by the time of the meeting of creditors, which is about a month after filing.

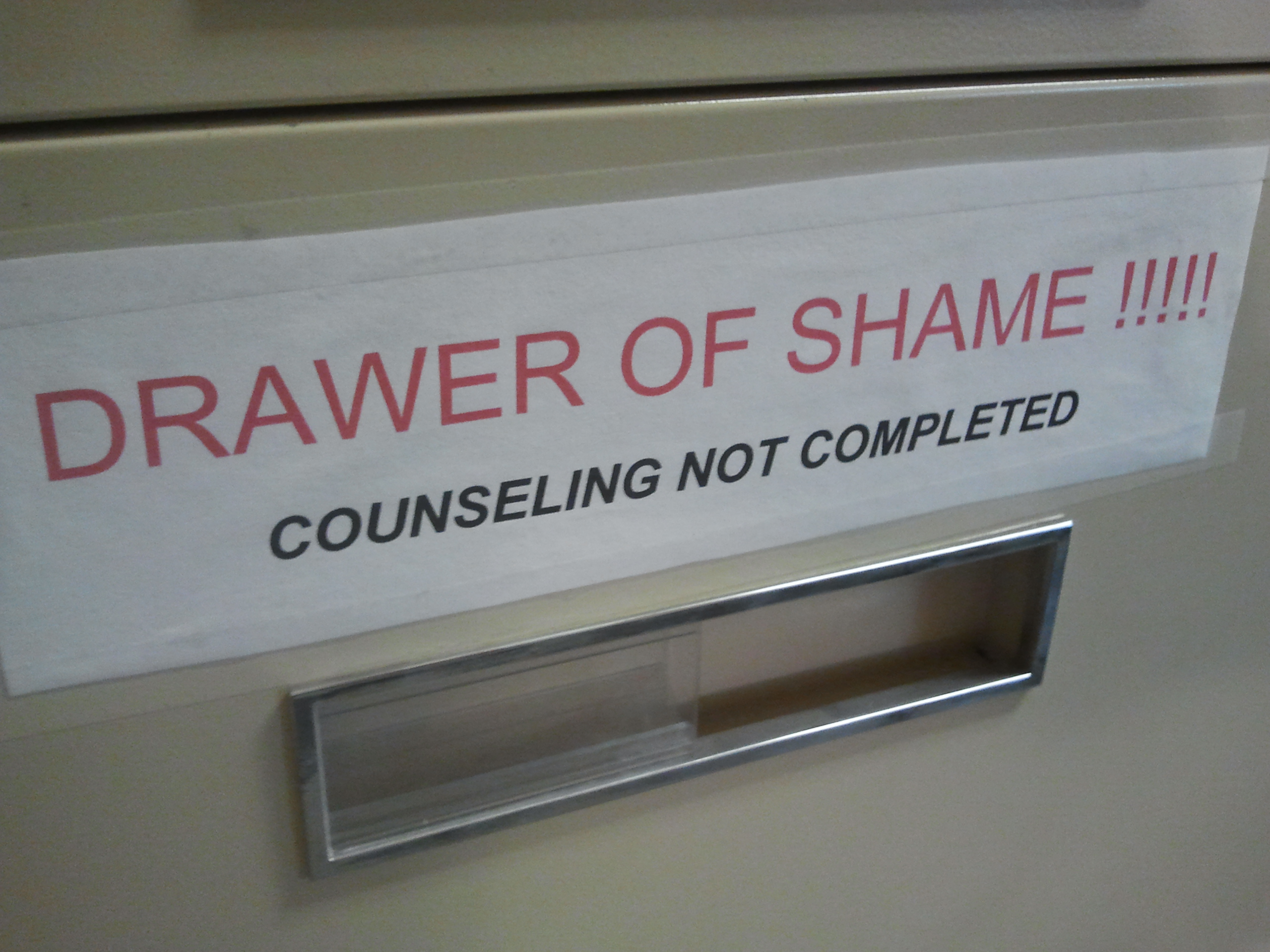

If the second course is not done by then, I keep track of that fact by moving the file to my “drawer of shame.” It has a big label on it in red letters. My goal then is to bug those clients until the second course is done. It would be a terrible shame to have a case that is otherwise going well fail because of that. One time it was actually down to the last 24 hours before my client got it done. That one had me actually calling my client’s mother.

I’ve never had a case where a client has actually missed the deadline. The lawyers I know who have clients that have missed it tell me that every one of them blames the lawyer, even though the lawyer sent all kinds of reminders.